Picture supply: Getty Photographs

Pressure and confusion over US plans for main new commerce tariffs are placing inventory markets in a tailspin. The FTSE 100 main index of shares has dropped 281 factors in simply over per week to eight,590 factors.

That is no shock. Tariffs usually disrupt international provide chains, enhance manufacturing prices, and put the dampener on shopper and enterprise spending.

But the potential affect received’t be the identical for all Footsie firms. New import taxes may very well be a serious drawback for Rolls-Royce, as an illustration, given its advanced provide chains and dependence on international markets. But the affect on home utilities shares like Nationwide Grid may very well be extra negligible, given their give attention to the UK and the important providers they supply.

With this in thoughts, listed below are two extra FTSE 100 shares to think about within the present landcape.

1. Coca-Cola HBC

Coca-Cola Hellenic Bottling Firm‘s (LSE:CCH) non-US operations supplies nice safety from the specter of Washington-led commerce tariffs.

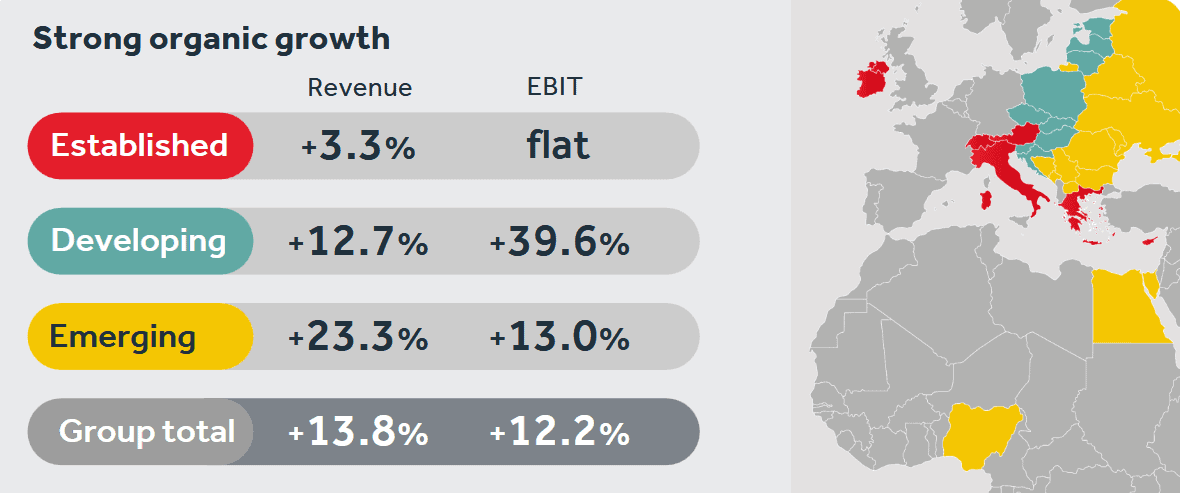

As you possibly can see, the enterprise focuses its efforts on the developed and fast-growing territories of Africa and Europe. This regional combine supplies an added bonus too. As you possibly can see, substantial publicity to rising and creating markets is supercharging gross sales and earnings progress.

Commerce wars might have wider financial implications for Coca-Cola HBC’s markets. However I’m not anticipating this to have a considerable affect on shopper demand, reflecting the star energy of drinks manufacturers like Coke, Fanta and Sprite.

I’m extra involved concerning the extremely aggressive atmosphere that the corporate operates in. Strain from the likes of PepsiCo and Nestle is a continuing menace to gross sales volumes and margins.

That mentioned, I’m assured that Coca-Cola HBC on stability can preserve delivering the products, supported by its packed portfolio of heabyweight labels and powerful file of innovation.

2. Fresnillo

Treasured metals shares like Fresnillo (LSE:FRES) may very well be among the many best beneficiaries of US-led commerce tariffs.

Import taxes may elevate inflation and gradual the worldwide economic system, each of that are historic price drivers for gold and silver.

The US greenback may additionally proceed to weaken ought to tariffs hammer the American economic system extra particularly. This naturally boosts demand for dollar-denominated commodities by making them more economical to purchase.

Estimates from the Nationwide Institute of Financial and Social Analysis (NIESR) illustrate the size of the potential injury. They assume fres commerce wars may increase US inflation by 3.5-5% over the following two years. It additionally suggests US actual GDP may very well be up to 4% decrease than it might be with out new tariffs.

Fresnillo isn’t fully with out danger although. Silver’s used for a wide selection of business functions, and so its demand is closely delicate to broader financial circumstances.

However weak spot right here may very well be offset by robust funding demand for silver, reflecting the metallic’s safe-haven properties. The Mexican miner’s gold gross sales would additionally possible rip even increased if the economic system tanks.