Picture supply: Getty Pictures

Penny shares may be famously thrilling investments. And never essentially in a great way.

These small-cap shares are sometimes younger firms which have vital progress potential. If issues go proper, they’ll expertise blockbuster income progress that drives their share costs by means of the roof.

Nonetheless, penny shares also can usually expertise vital price volatility, a mirrored image of weak liquidity and excessive ranges of speculative buying and selling. They will fall particularly sharply when financial situations worsen and fears over their stability sheet power improve.

Shopping for low-cost

That is why it may be a good suggestion to purchase penny shares that carry low valuations. The danger of a pointy share price fall may be restricted, because the market has already taken a pessimistic view of the corporate’s prospects.

Shopping for any low-cost inventory has different benefits as effectively. If the corporate performs strongly, the share price can explode as traders recognise the true worth of the enterprise.

With this in thoughts, listed here are two high progress shares I believe are value an in depth look right this moment.

Gold star

Buying commodities shares generally is a wild trip. Costs of uncooked supplies are sometimes risky, which suggests these shares can soar or sink at a second’s discover.

However a vivid outlook for valuable metals means investing in gold producers could possibly be a good suggestion. Serabi Gold (LSE:SRB), which trades at 66.5p per share and has a market cap of £50.4m, is one such firm on my radar.

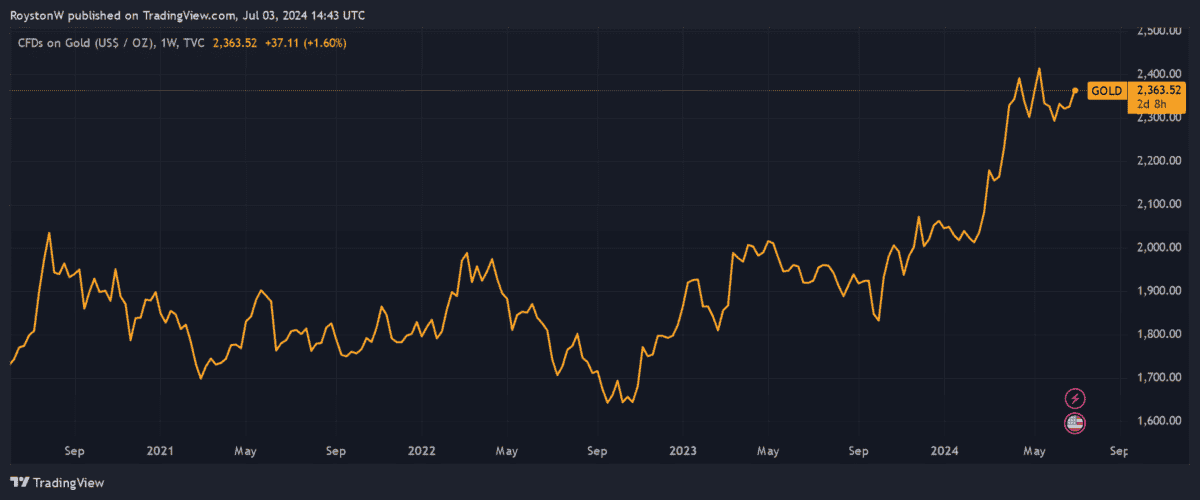

There’s no assure that gold costs will rise past Could’s report peaks round $2,450 per ounce. However a ‘perfect storm’ of things exists which may drive steel costs a lot increased. These embrace:

- Cussed world inflation

- Main electoral shifts in Europe (and particularly France)

- Vital authorities debt, notably within the US

- Continued weak spot in China’s economic system

- Rising Western tensions with Russia and China

However why purchase Serabi Gold shares to capitalise on this? For one factor, its shares provide good worth right this moment. The Brazilian miner trades on a rock-bottom ahead price-to-earnings (P/E) ratio of 4 occasions.

Gold manufacturing can be rising because the enterprise ramps up output at its Coringa asset. Group manufacturing rose 12.5% between January and March, representing the best quarterly whole since 2021.

Block occasion

Michelmersh Brick Holdings (LSE:MBH) is one other good worth penny inventory to contemplate right this moment.

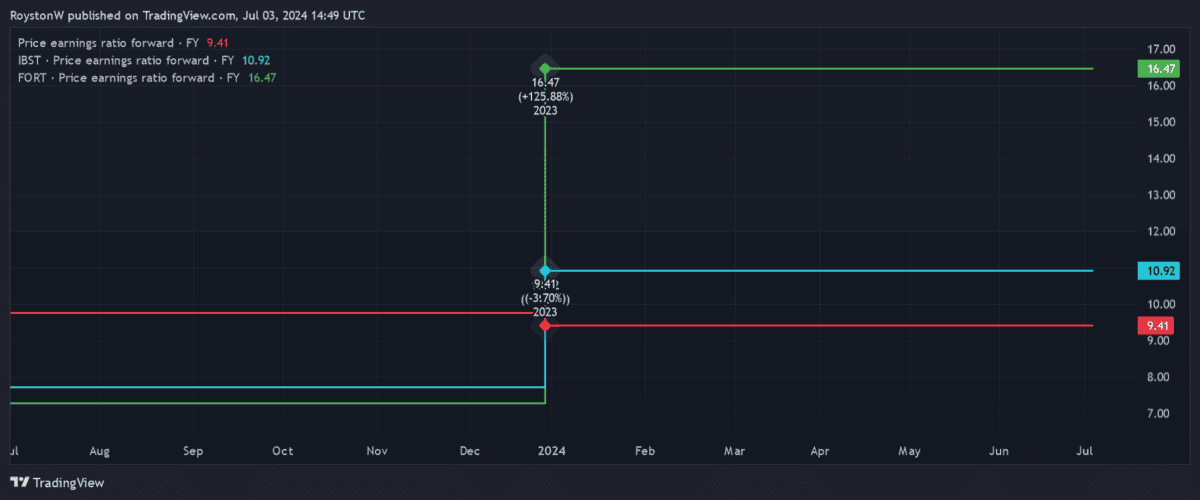

On the present price of 95.4p, the £93.7m cap enterprise seems considerably undervalued in comparison with a few of its friends. The hole between its ahead P/E ratio of 9.4 occasions, and people of rivals Ibstock (in blue) and Forterra (in inexperienced), is proven beneath.

What makes brickmakers like this such a lovely funding although? Admittedly, demand for houses within the UK is at present weak on account of higher-than-usual rates of interest. This can stay a risk if inflation fails to remain low.

Nonetheless, the long-term outlook for the housing market stays strong. Britain might want to ramp up housebuilding exercise considerably within the coming years to fulfill the lodging wants of its rising inhabitants. So gross sales of all types of development merchandise could possibly be set for lift-off.

Michelmersh also can count on brick demand from the restore, upkeep and enchancment (RMI) market to stay strong. Britain’s historical housing inventory requires fixed renewal to remain standing.