Picture supply: Getty Pictures

Incomes passive earnings by means of investing is an achievable objective, particularly when beginning with £100,000 — sufficient for a big home deposit.

Whereas this quantity may not create immediate passive earnings wealth, it serves as a robust basis to construct a gradual earnings stream over time. The important thing lies in beginning sensible, staying constant, and permitting time and compounding to work their magic.

With £100k, a wide range of funding choices can generate passive earnings. Dividend-paying shares present common payouts, whereas bonds provide secure curiosity funds. Actual property investments, whether or not by means of rental properties or REITs, can ship constant money circulate. Index funds, with their low charges and regular progress, additionally current a dependable technique to develop wealth.

The key to success entails reinvesting earnings early on. By investing in progress, redirecting dividends, curiosity, or rental earnings again into the portfolio, progress accelerates. Over time, this compounding impact can rework £100k right into a a lot bigger sum, considerably growing passive earnings potential.

Utilizing an ISA to compound wealth

The Shares and Shares ISA is a wonderful automobile for constructing wealth. That’s as a result of earnings and positive factors from investments inside the ISA are shielded from UK taxes, together with earnings tax and capital positive factors tax. In different phrases, if an traders sells a inventory that’s surged 100%, they maintain all of the income. This permits investments to compound a lot quicker.

Please notice that tax remedy depends upon the person circumstances of every shopper and could also be topic to alter in future. The content material on this article is offered for data functions solely. It isn’t meant to be, neither does it represent, any type of tax recommendation. Readers are liable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

Briefly, £100,000 might compound into one thing a lot bigger over the long term when invested properly. Mixed with £200 of month-to-month contributions and 10% annualised progress, £100,000 might turn out to be £2.4m in 30 years. Assuming a withdrawal price round 5%, this pot might generate round £10,000 a month.

An investments for the job?

Traders favouring a extra hands-off method could flip to a belief for diversification, and The Monks Funding Belief‘s (LSE:MNKS) definitely an attention-grabbing prospect to contemplate with its deal with international fairness investments aimed toward delivering above-average long-term returns.

Managed by Baillie Gifford — which additionally runs the favored Scottish Mortgage Funding Belief — the belief employs a affected person, lively administration technique, focusing on firms that tackle crises innovatively to cut back prices or enhance service high quality.

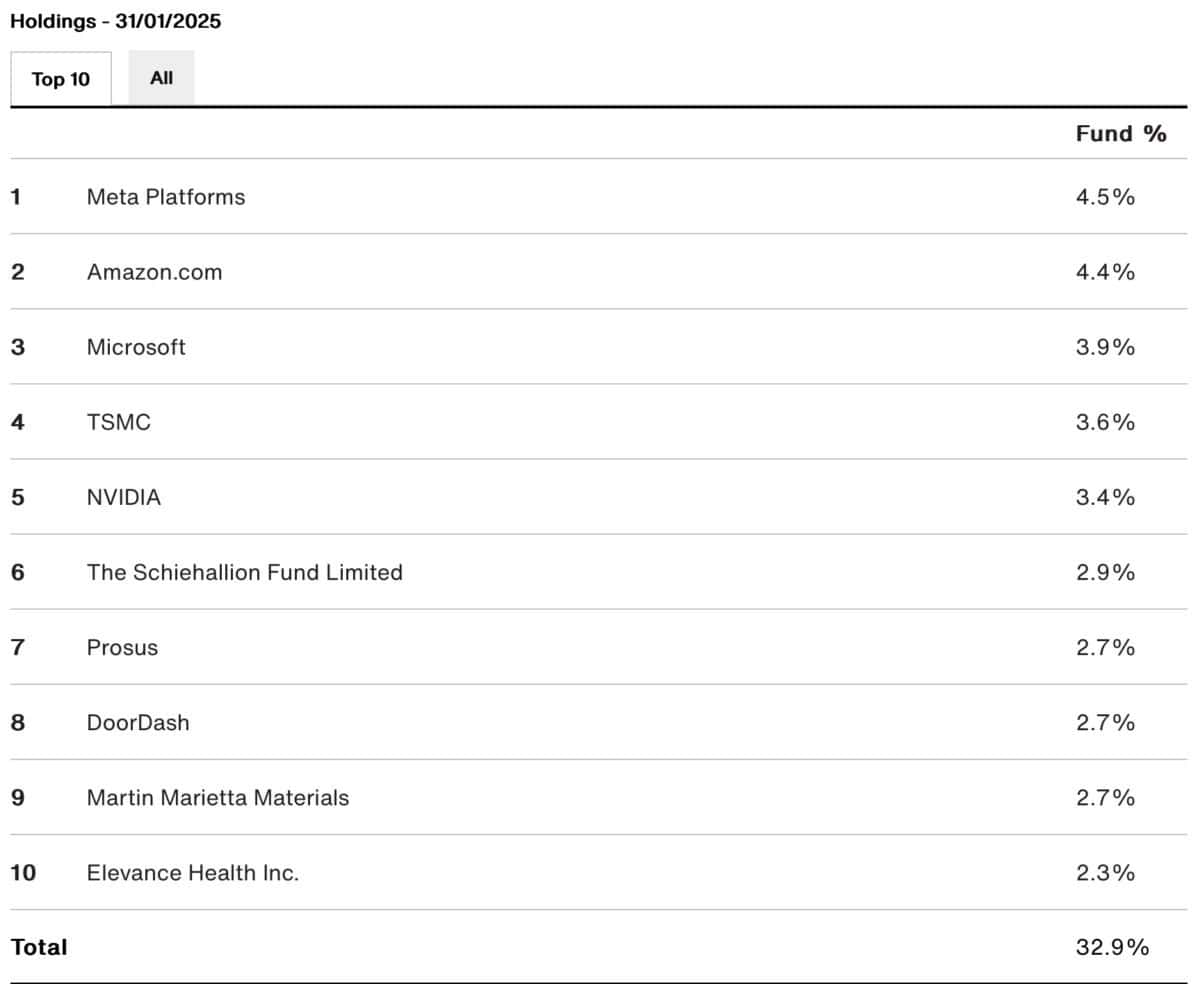

The belief’s portfolio is diversified throughout areas, together with North America (62%), Europe (14.5%), and the UK (3.3%), and sectors corresponding to know-how, healthcare, and shopper items. And with a low ongoing cost of 0.44% and no efficiency charges, it presents price effectivity.

Over the previous decade, Monks has delivered robust efficiency, with a 246.2% share price progress, reflecting its capability to climate market volatility whereas specializing in capital progress. This additionally displays the robust efficiency of tech shares over the interval.

Understandably, some traders could also be involved about its weighting in direction of huge tech, which has underperformed over the previous month and has loads of company-specific danger. But the belief’s portfolio is balanced, providing a low-maintenance choice with a confirmed observe document.