Picture supply: Getty Photos

Authorized & Common Group‘s (LSE:LGEN) been one of many FTSE 100‘s hottest dividend shares in recent times.

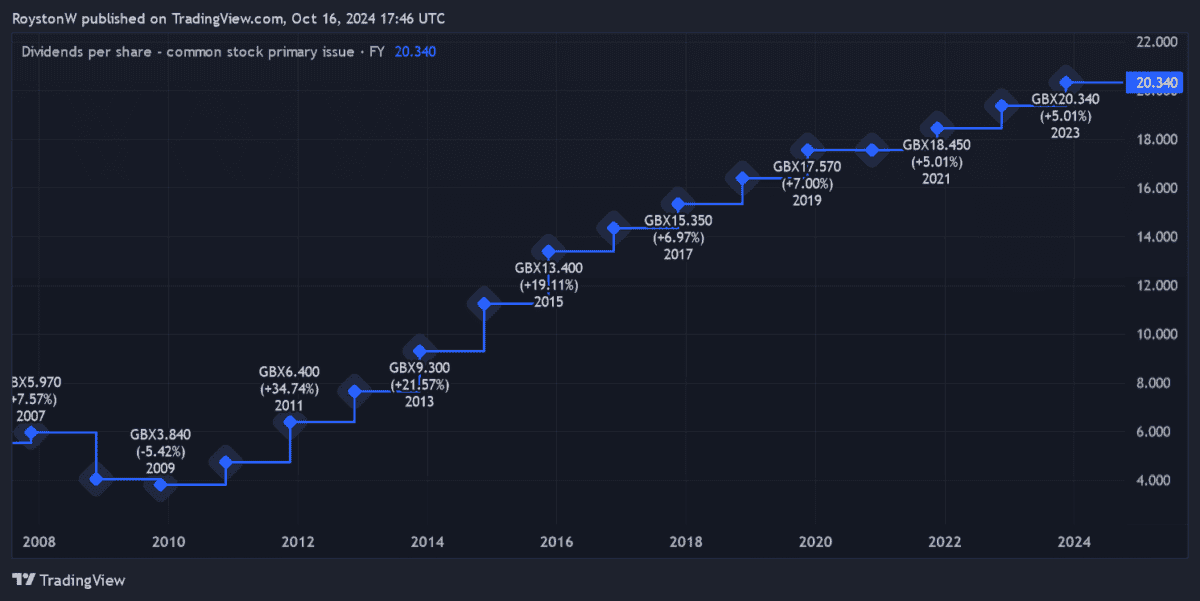

The monetary providers big hasn’t simply hiked annual payouts virtually yearly for the reason that 2008/2009 monetary disaster (as proven beneath), however its dividend yields have additionally trounced the Footsie common over the interval.

Dividends are by no means, ever assured. However there’s excellent news for homeowners of Authorized & Common shares like me. Metropolis analysts are tipping the corporate to pay a big and rising dividend by means of to 2026, no less than.

Utilizing a £10,000 funding in the present day, how a lot passive earnings may I generate?

9.8% dividend yield

As an asset supervisor, life insurer and retirement product supplier, earnings right here can disappoint when customers in the reduction of and rates of interest rise. Certainly, these elements contributed to double-digit earnings declines in each of the previous two years.

Nonetheless, the corporate’s wealthy stability sheet means it’s been capable of maintain climbing dividends. In 2023, the annual dividend on Authorized & Common shares rose 5% to twenty.34p per share.

Encouragingly, Metropolis analysts assume money rewards will maintain rising by means of to 2026 no less than, as indicated within the desk beneath.

| Yr | Dividend per share | Dividend progress | Dividend yield |

|---|---|---|---|

| 2024 | 21.32p | 5% | 9.3% |

| 2025 | 21.83p | 2% | 9.5% |

| 2026 | 22.36p | 2% | 9.8% |

These forecasts are consistent with Authorized & Common’s plans. And as you possibly can see, dividend yields sail above the historic FTSE 100 ahead common of 3-4%.

I’m anticipating dividends to proceed rising over this era too. However even when dividends fail to develop past 2026, a £10,000 lump sum funding may nonetheless present me with a month-to-month passive earnings above £600.

£623 a month

If dealer estimates are correct, I’d make £980 in dividend earnings in 2026, and £9,800 over a decade. Over 30 years, I’d take pleasure in a £29,400 passive earnings.

However I may make much more if I have been to reinvest these shareholder payouts. Due to the mathematical miracle of compounding, after 10 years, I’d have generated £16,539 in dividends.

And after 30 years, I’d have made a complete passive earnings of £176,913, greater than six instances the £29,400 I’d have made with out reinvesting.

After including my £10,000 preliminary funding, my portfolio could be value £186,913 (assuming no share price progress). If I then drew down 4% annually, I’d have an annual passive earnings of £7,477 and a month-to-month considered one of £623.

A prime choose?

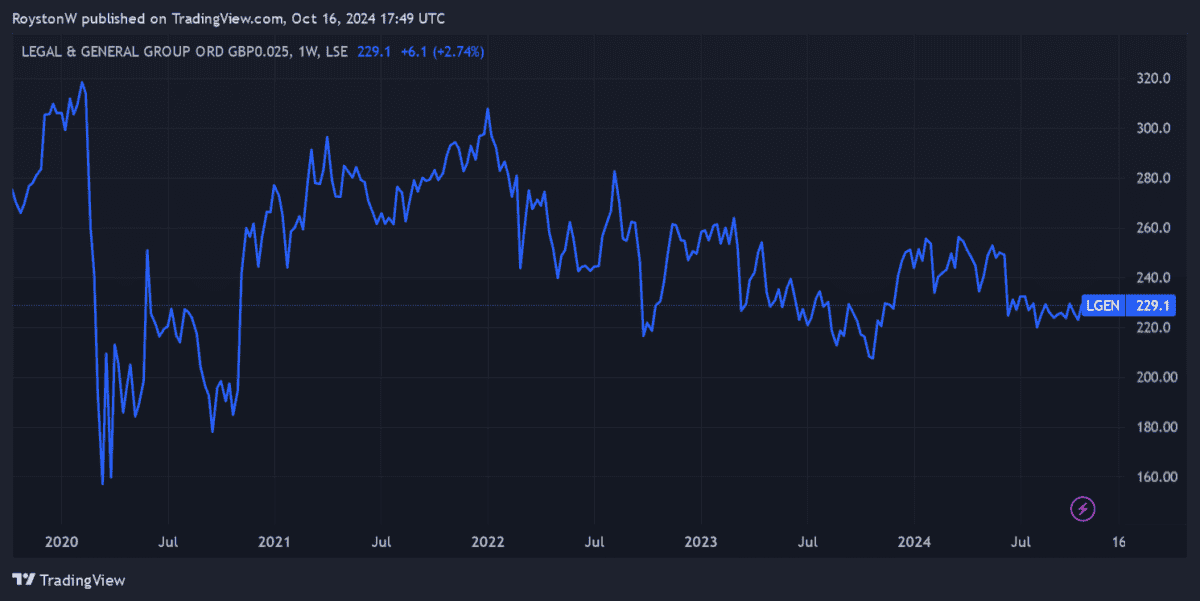

Authorized & Common’s share price has struggled for traction since late 2022, as proven above. This displays the influence of upper rates of interest — which stay a menace going forwards — on its buying and selling efficiency.

Nonetheless, over the following 30 years, I’m anticipating the enterprise to ship wholesome share price features and ample dividend earnings, pushed by altering demographics. And so I may need a good larger passive earnings to stay off than that £623 talked about above.

So long as Authorized & Common’s stability sheet stays strong, it’ll be capable of proceed paying giant dividends and make investments for progress. Issues actually look good proper now, with the agency concentrating on £5bn-£6bn value of operational surplus money technology between 2025 and 2027.

I believe Authorized & Common shares are value a severe look from dividend buyers.