Picture supply: Getty Photographs

The S&P 500 has been rocked by volatility recently. The truth is, it’s down 8.7% in just below a month! That’s a pointy fall for the benchmark index and means $4trn has been worn out since its peak in February.

It additionally signifies that an investor who had ploughed 10 grand into an S&P 500 index fund a month in the past could be down 7.5%. In different phrases, they’d now have about £9,250 (discounting trade charges). Whereas not disastrous, that’s in all probability not what they had been anticipating after simply 4 weeks.

Zooming additional out although, the index is over 140% larger than it was through the Covid crash 5 years in the past. And it has practically tripled over 10 years, together with dividends.

So it’s essential to keep in mind that 4 weeks is merely the blink of an eye fixed within the context of the inventory market.

What’s occurring recently?

The market hates uncertainty, because the outdated saying goes. And President Trump brings plenty of that to the desk, with nearly every day tariff threats in opposition to commerce companions.

These have centred on China, Canada, and Mexico. However Trump says the EU was “formed to screw the United States” and has additionally threatened it with 25% tariffs. The UK appears to be an afterthought for now.

Is anybody actually shocked by all this? In any case, we had the primary Trump administration to go on. In late 2018, I keep in mind my portfolio dropped greater than 30% within the area of some weeks when he initiated a commerce battle with China.

So I used to be baffled when the US market took off like a rocket after the November election. And my outlandish prediction in January that Tesla inventory would drop 40% this yr may truly come true (it’s at present down 45% yr so far).

Market corrections provide alternatives

However with the Nasdaq Composite now already deep in correction territory (down greater than 10%), and the S&P 500 not far behind, I feel there are engaging shopping for alternatives rising for my portfolio.

One inventory I’ve been watching is Amazon (NASDAQ: AMZN). To my disgrace, I’ve by no means owned shares of the e-commerce and cloud computing juggernaut.

The inventory has greater than doubled in 5 years and is up round 900% over a decade!

Nevertheless, it has fallen 20% in a month, leaving it wanting low-cost(ish) on some metrics. For instance, the shares are at present buying and selling for about 12 occasions subsequent yr’s anticipated working money move, which is considerably cheaper than earlier years.

Naturally, a possible US recession may influence the corporate’s e-commerce division. That is the principle danger I see right here, together with rising worldwide competitors from low-cost procuring apps like Temu.

Nevertheless, I’m more and more bullish on Amazon’s place in synthetic intelligence (AI). It’s aggressively incorporating generative AI into its AWS platform, whereas seeing an enormous alternative in AI brokers. These are superior AI programmes able to independently performing duties and making selections.

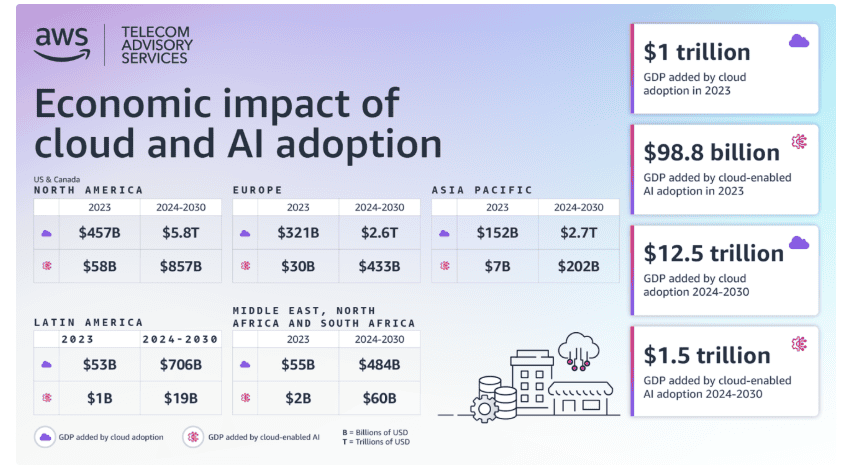

AWS is well-positioned to dominate a major a part of this rising market by supplying each computing energy/storage and the specialised instruments needed to construct and function AI brokers.

Final yr, income at AWS jumped 19% to $107.6bn, up from $45bn in 2020. And it seems set to rise even larger as international adoption of cloud providers and AI utilization motors on.