Picture supply: Getty Photos

Fast earnings progress over the past decade has seen the worth of Greggs‘ (LSE:GRG) shares explode over the past decade.

Somebody who invested £10,000 within the FTSE 250 baker again in mid-April 2015 would have seen the worth of their shares rise to £15,999. Over the interval, its share price has leapt from £11.33 to £18.15 at present.

When additionally factoring in dividends, an investor would have made a cumulative revenue of £10,157. That represents a complete shareholder return of 101.6%.

However stormclouds have gathered over Greggs extra not too long ago, and its share price has fallen sharply from 2024’s closing excessive of £31.84 reached in September.

Ought to buyers at present think about grabbing a slice of the sausage roll maker? Or is the corporate previous its best-before date?

Enlargement continues

Greggs’ story for a lot of the previous decade has been one in every of aggressive growth and a subsequent surge in income. From having 1,650 shops simply over 10 years in the past, the enterprise now has 2,618 (comprising 2,057 company-managed shops and 561 franchised items).

Having discovered the suitable recipe for earnings progress, the corporate, maybe unsurprisingly, has no plans to backtrack. New retailer openings hit a yearly report in 2024, and Greggs plans to have “significantly more than 3,000 shops” in its portfolio over the long run.

It’s investing huge sums in manufacturing and distribution to make this a actuality too. In actual fact, the enterprise believes two new websites in Derby and Kettering — slated to open in 2026 and 2027 respectively — will present sufficient capability for some 3,500 retailers.

Encouragingly, Greggs plans to website a better variety of its new shops in high-traffic locations too, reflecting its pivot away from the excessive road. Extra particularly, it plans to centre future growth in direction of journey locations akin to airports and prepare stations.

The agency’s gearing up to additional prolong opening hours throughout its retailer property too, to seize the profitable night ‘food to go’ market. Greggs additionally has plans to maintain investing in its supply channel following current spectacular buying and selling. Supply revenues grew by a formidable 30.9% in 2024, regardless of the powerful buying and selling surroundings.

27.6% rebound?

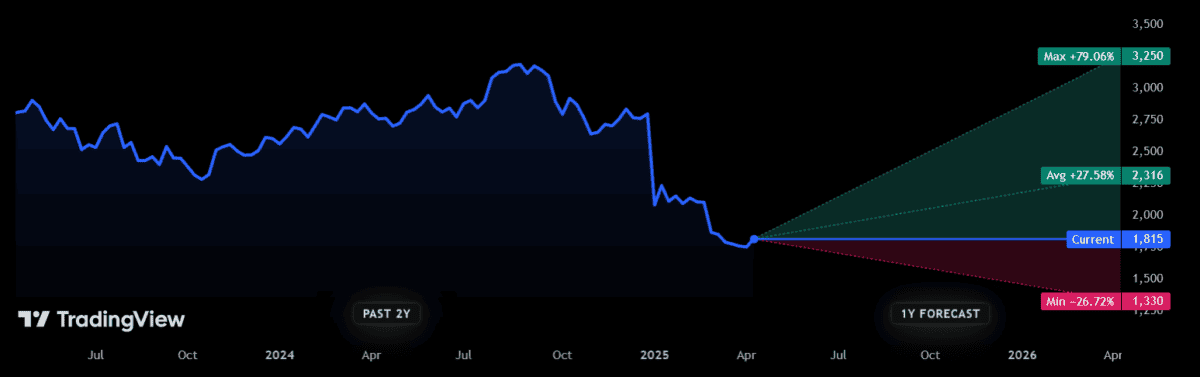

I’m hoping that these components will assist Greggs’ share bounce again following current heavy dips. Encouragingly, the dozen analysts with scores on the inventory anticipate costs to rebound over the subsequent 12 months, although forecasts aren’t uniformly bullish.

One particularly enthusiastic dealer issues Greggs shares will surge from £18.15 at present to £32.50 within the subsequent 12 months. On the different finish of the dimensions, one other analysts reckons the baker will drop all the way in which again to £13.30.

The common price goal nevertheless, sits at £23.16. That represents a 27.6% rise from present ranges.

Are Greggs shares a purchase?

On steadiness, I believe Greggs shares are price critical consideration following current share price weak point. It now trades on an inexpensive price-to-earnings (P/E) ratio of 13.3 occasions.

It’s true that buying and selling circumstances may stay difficult within the close to time period as shopper spending stays constrained. It additionally faces vital competitors on the excessive road and elsewhere.

Reflecting these pressures, like-for-like gross sales progress at Greggs cooled to five.5% in 2024 from 13.7% a yr earlier. Nevertheless, my long-term view of the bakery chain is undimmed. I consider Greggs’ share price will rebound sharply when broader financial circumstances enhance.