Picture supply: Getty Pictures

The final decade’s been a story of two halves for Aviva (LSE:AV.) shares. Technique points, mixed with challenges throughout the Covid-19 pandemic, pushed the FTSE 100 enterprise to its least expensive because the Nice Monetary Disaster of 2020. Its lowest level got here in March that yr when it struck 203.23p per share.

However the share price has rebounded sharply from these troughs. Helped by a strong (if bumpy) financial restoration, to not point out an enormous restructuring beneath chief govt Amanda Blanc from summer season 2020, the monetary providers large has bounced again and was extra not too long ago buying and selling at 543.8p.

Sub-FTSE 100 returns

All of because of this somebody who invested £10,000 in Aviva shares a decade in the past would have seen the worth of their funding rise to £10,442. That displays a share price rise of 4.4% from 520.68p.

That’s a reasonably mediocre return, I’m certain you’d agree. However when additionally contemplating dividends paid in that point, the image modifications lots.

Dividends have totalled 240.2p per share in that point. When added to Aviva’s share price positive aspects, somebody who invested £10k a decade in the past would now have £15,055 to point out for it, reflecting a complete shareholder return of fifty.6%.

However I’m not executed but. I’m a giant fan of Aviva shares — the corporate is a key plan in my very own portfolio — but the full return since spring 2015 nonetheless lags the 85.1% that the FTSE 100’s dished out in that point.

Can the monetary providers agency ship a greater return trying forward?

Aviva forecasts

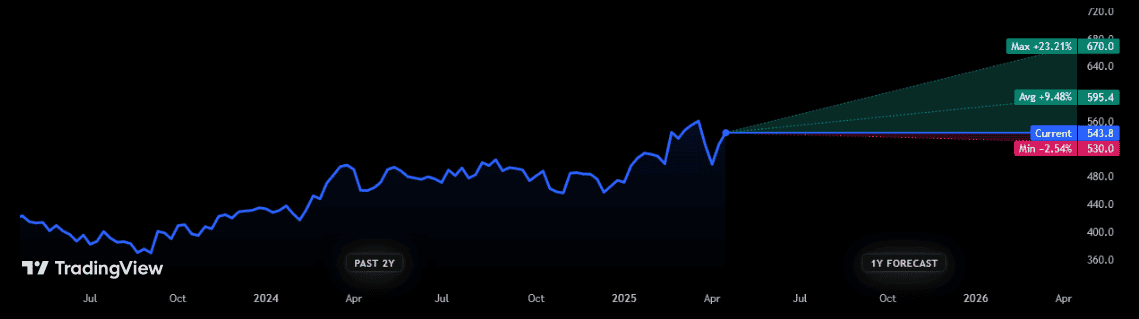

Sadly, dealer forecasts for Aviva’s share price aren’t out there for the following 10 years. Nonetheless, they’re out there for the approaching 12 months. And so they largely paint a constructive outlook.

The 12 analysts with rankings on Aviva shares assume costs will rise by near double-digit percentages. One thinks they’ll recognize by virtually 1 / 4, although such positivity isn’t unanimous — one bearish dealer thinks costs will backpeddle by low single digits.

It’s necessary to notice that powerful financial situations may hinder such price positive aspects trying forward. Moreover, intense competitors may additionally restrict future progress by hitting revenues and revenue margins.

But I’m optimistic that Aviva may soar in worth, each in 2025 and lengthy past. Its rising deal with capital-light companies — which not too long ago noticed it snap up Direct Line and AIG‘s life insurance coverage enterprise — ought to give earnings a major shot within the arm.

A deal with safety, wealth and retirement merchandise may additionally assist raise Aviva’s share price, proving a number of methods for it to capitalise on demographic modifications. Its bulk annuity enterprise particularly presents substantial progress potential.

Dividend increase

This additionally means Aviva (in my opinion) appears to be like in fine condition to maintain rising dividends, offering an extra substantial increase to shareholder returns.

Certainly, analysts assume dividends will proceed rising via to the tip of subsequent yr a minimum of. Aviva’s rock-solid steadiness sheet means present estimates look very a lot achievable as nicely (the Solvency II capital ratio right here is 203%, newest financials present).

Between 2025 and 2027, the dividend yields on Aviva shares vary from 7% to eight.1%. Each readings are subtantially above the three.7% common for FTSE 100 shares.

Whereas nothing’s assured, I count on Aviva to ship Footsie-beating returns over the following 10 years, making it value critical consideration.