Picture supply: Getty Photos

Aston Martin (LSE: AML) shares have carried out woefully for ages. Within the three months main up to Christmas, the share price was skidding downhill like a automobile on an icy bend. However that 34% drop was nothing in contrast with what had gone earlier than — down 93% within the earlier 5 years!

The FTSE 250 inventory has fallen one other 44% since Christmas Eve and at present sits at simply 58p. This implies anybody who made a £10k funding when presents have been nonetheless beneath twinkling timber would now have simply £5,600.

What has gone mistaken?

There are just a few key the reason why the inventory has crashed, however most relate to the posh automaker’s stability sheet. On the finish of 2024, Aston Martin’s internet debt was roughly £1.16bn, reflecting a 43% improve from the earlier yr.

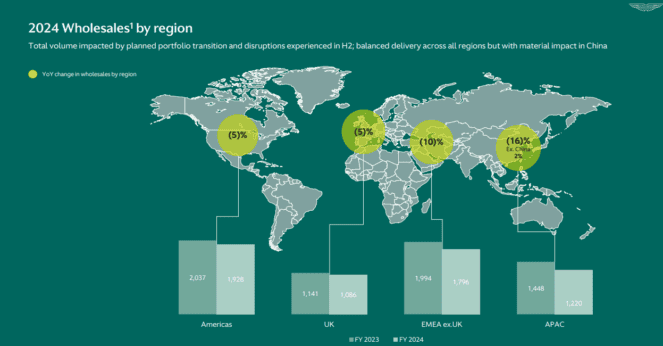

The annual pre-tax loss got here in at £289m, up from £240m, on income of £1.58bn (down 3%). Provide chain points and weak markets noticed wholesale volumes slip 9% to six,030 autos. China gross sales have been particularly unhealthy, as they’ve been for many luxurious items firms.

Taking vital measures

To shore up the stability sheet, the Yew Tree Consortium, led by government chairman Lawrence Stroll, elevated its stake within the carmaker to 33%. The corporate additionally bought its minority stake within the Aston Martin Aramco Components 1 staff, elevating about £125m from each transactions.

On high of this, Aston will reduce roughly 5% of its international workforce.

CEO Adrian Hallmark commented: “By strengthening the balance sheet, this investment provides additional headroom to support our future product innovation and business transformation activities, which combined, will accelerate our progress into being a sustainably profitable company.”

This fundraise is well-timed, as the corporate will want “additional headroom” now that President Trump’s 25% tariffs on all foreign-made carmakers have been introduced. The corporate doesn’t have the capital to set up manufacturing stateside, so these looming taxes will virtually actually heap extra stress on margins.

New fashions on sale

Aston does have a refreshed line-up of autos, together with high-margin particular version fashions like Valkyrie, Valour, and Valiant. Deliveries of Valhalla, its hybrid supercar, are attributable to begin within the second half. The CEO says that is the “strongest product portfolio in our 112-year history.”

In the meantime, the event of its first electrical car (EV) has been placed on the backburner for just a few years. This is sensible to me as we don’t even know whether or not Aston clients will actually need EVs by 2030. Or whether or not authorities net-zero targets will likely be watered down.

Restoration potential?

I’ve typically checked out Aston shares over the previous 18 months and thought they may stage an epic comeback in some unspecified time in the future. However that may finally rely on enhancing fundamentals and we’re not seeing that.

The agency’s historical past of losses and stability sheet danger means I don’t really feel snug investing right here. Additionally, the sheer quantity of uncertainty being unleashed by the creating international commerce struggle isn’t going to be nice for gross sales of virtually something.

Proper now, the inventory market is crashing attributable to these fears. On this state of affairs, I wish to be including shares of resilient firms to my portfolio. Ones that I believe can climate this Class 5 hurricane and probably emerge stronger.

Sadly, I don’t suppose that’s Aston Martin.