Picture supply: Getty Photographs

I feel Authorized & Normal (LSE:LGEN) is without doubt one of the greatest FTSE 100 shares to think about for a big and passive revenue. It’s why I’ve made the monetary providers big the biggest single holding in my Self-Invested Private Pension (SIPP).

During the last decade, the corporate has raised dividends yearly aside from 2020. In response to the worldwide pandemic, it froze the annual payout at 17.57p per share.

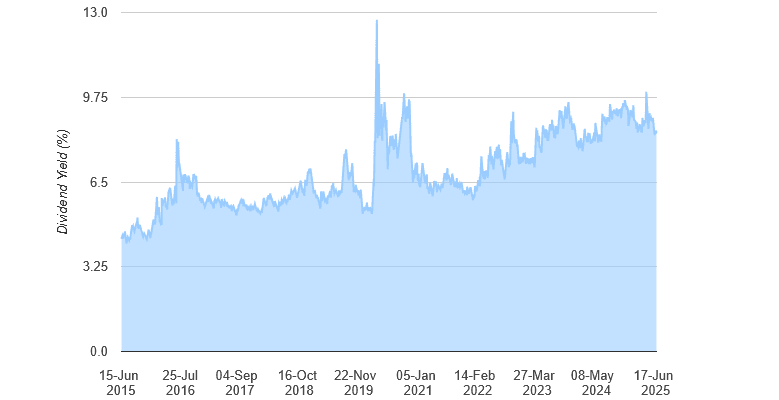

Dividends have risen strongly since then, culminating in final 12 months’s 21.36p payout. It implies that dividend yields have crept near double-digit-percentage territory:

Because of this, somebody who purchased £10,000 price of Authorized & Normal shares 10 years in the past would have loved a complete passive revenue of £4,392.91 in that point. That’s based mostly on cumulative dividends of 97.09p per share.

That’s a reasonably tasty end result, I’m positive you’d agree. However can the FTSE 100 agency proceed delivering market-beating dividends? Right here’s what Metropolis analysts suppose.

8.9% dividend yield

Previous efficiency just isn’t at all times a dependable information to future returns. However the 14 brokers with rankings on Authorized & Normal anticipate it to maintain paying a rising and market-beating dividend throughout the subsequent few years at the very least.

| 12 months | Dividend per share | Dividend development | Dividend yield |

|---|---|---|---|

| 2025 | 21.82p | 2.1% | 8.6% |

| 2026 | 22.32p | 2.3% | 8.8% |

| 2027 | 22.76p | 2% | 8.9% |

Because the desk above reveals, analysts anticipate dividends to develop on the tempo the enterprise forecast final 12 months when it up to date its payout coverage.

This additionally implies that dividend yields via to 2027 are greater than double the Footsie’s long-term common of three%-4%.

But, as we noticed in 2020, there’s no assure that dividends will rise regardless of Authorized & Normal’s greatest intentions and the bullishness of Metropolis analysts. And within the present financial local weather, I’m conscious that earnings might underwhelm if client confidence weakens, impacting dividends within the course of.

That is particularly regarding given how skinny dividend cowl is on the firm. Predicted money rewards are lined between 1 instances and 1.2 instances by anticipated earnings, beneath the specified minimal of two instances that gives a margin of security.

So why are forecasters so bullish? It comes down to the agency’s spectacular money era that offers it the strongest Solvency II protection ratio within the sector. At 232%, Authorized & Normal’s capital ratio was greater than double the regulatory minimal as of the shut of December.

Certainly, its sturdy monetary foundations imply the corporate’s additionally deliberate a sequence of share buybacks via to 2027. With dividends and inventory repurchases mixed, it plans to return a complete of £5bn to shareholders over the interval.

A FTSE 100 ‘lifer’

Authorized & Normal is a share I plan to carry for the remainder of my life. It could expertise some near-term turbulence, as we’ve seen throughout earlier downturns. However over the long run, I anticipate it to ship spectacular capital positive aspects and dividend revenue.

Demand for wealth administration providers, pensions, and different retirement merchandise ought to rocket as international populations quickly age. And Authorized & Normal has unimaginable model energy and (as I’ve talked about) substantial monetary assets to completely capitalise on this chance. It is a UK blue-chip share I plan to by no means promote.