Picture supply: Getty Pictures

The S&P 500 has elevated by greater than 23% in three out of the final 4 years. Whereas nice for traders’ portfolios, it’s additionally sobering to suppose that the final time returns have been as sturdy as this was within the lead up to the dot.com market crash.

Consequently, a rising variety of commentators are turning bearish on the S&P 500’s prospects in 2025.

This would possibly lead some traders to contemplate promoting in case their shares take a tumble. I believe that may be a mistake although. Right here’s why.

Avoiding market timing

A market crash is commonly outlined as a speedy drop of greater than 20%. The issue is that no one actually is aware of for sure when one will occur.

So, if I promote my shares in anticipation of 1, what do I do if shares proceed to go up in 2025? Then once more in 2026? I’d see the good points I’m lacking out on and dive again in, at a premium, simply earlier than it truly does crash or begins sliding in direction of a bear market.

Furthermore, I’d should be proper twice for this transfer to achieve success. There could be the exit, getting out simply in time to save lots of my portfolio from a painful drop. Then I must re-enter the market on the proper time earlier than it recovered and began to chug upwards once more. However all research on market timing reveals that that is virtually unattainable to get proper.

So, what if the market does rapidly crash and I’m left with a badly bruised portfolio? Once more, the worst factor to do right here could be to promote my shares. The reason is that over the previous 20 years, 7 of the ten finest market days occurred simply a few weeks after the worst 10 days, in keeping with JP Morgan.

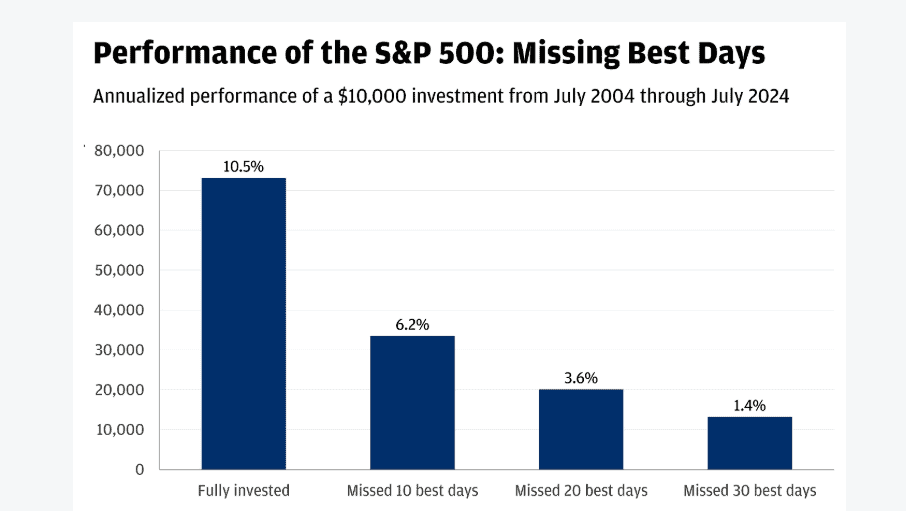

Staying absolutely invested, a $10,000 funding within the S&P 500 in 2004 would have grown to over $70,000 by final yr. However lacking the ten finest days via wrongly timing the market would have reduce that to below $35,000!

The important thing then is for me to keep away from panic promoting and keep invested.

In search of a greater price

Earlier this week, AI chip shares plunged after a Chinese language start-up unveiled a seemingly cheaper-built model of ChatGPT. This solid doubt on the huge prices associated to the continuing AI buildout.

Had been these considerations to snowball and set off a crash, I’ll be eager to purchase extra shares of CrowdStrike (NASDAQ: CRWD). That is the AI-powered cybersecurity firm whose title got here to the general public’s consideration for all of the unsuitable causes again in July when a defective software program improve triggered a worldwide IT outage.

The share price crashed 38% after this incident, however has since bounced again strongly, rising 82%.

Whereas I’m relieved about this, it’s additionally left the inventory trying very expensive at 27 instances gross sales. This lofty valuation leaves little room for error, significantly if one other software program incident or, worse, cybersecurity breach of its platform takes place.

Nevertheless, as of the final quarter, 66% of consumers have been utilizing 5 or extra of its cybersecurity modules, whereas a powerful 20% have been utilizing eight or extra. So the software program debacle appears to have triggered little lasting injury.

Wanting forward, analysts nonetheless count on CrowdStrike’s income and earnings to develop above 20% till at the least 2028.